Introduction

Canada, as a signatory to the Paris Agreement, plans to achieve net zero by 2050 (Government of Canada, 2023). The potential for a high return on investment in renewable energy in Canada is high because of this political external factor. Canada has long identified and improved its capabilities in especially hydroelectricity but also wind, etc. as its abundant sources of renewable energy.

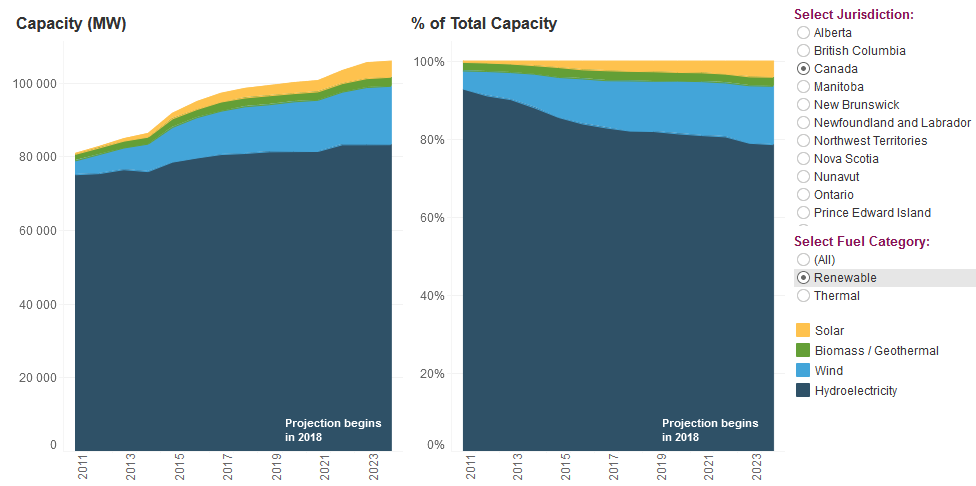

Figure 1: Canada’s Renewable energy capacity (Government of Canada 2022)

However, due to the intermittency, decentralisation issues and lower energy intensity from these renewable energy sources, investors interested in Canada, are reluctant to develop renewable energy systems for hard to abate sectors like heavy industry and manufacturing, heating of buildings, long haul transportation, etc. all of which are highly energy intensive (Prussi and Chiaramonti 2022), hence the debate on integrating fossil fuel with Carbon Capture in the 2050 net zero scenario (Paltsev et al. 2021).

Canada’s Clean Industry Act and Hydrogen strategy

Recognising these challenges with renewable energy sources, Canada in 2021 enforced the “A Healthy Environment and a Healthy Economy – Clean industry” policy, with subheading: “Building Canada’s Clean Industrial Advantage”, which essentially prepares Canada’s industries to fully transition to a Hydrogen economy by 2050 (IEA 2023a, Environment and Climate Change Canada 2021).

Several researchers consider Hydrogen fuel as the silver bullet to the energy challenges of the net zero economy (Yang et al. 2022; Franco and Giovannini 2023).

However, it is worth noting that Hydrogen fuel is only a secondary form of energy source hence its classification is based on the method of production as I have shown below:

Barriers to widespread Hydrogen fuel deployment in Canada

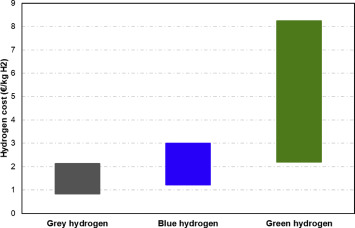

Although Blue and Pink Hydrogen can be arguably considered ‘Clean Hydrogen’, researchers focus on Green Hydrogen which is the most valuable of all with more promising return on investment and most economically viable in a net-zero Canada (Wappler et al. 2022) if the following barriers to its deployment can be overcome.

- Cost Barrier:

The cost of Green Hydrogen production is as high as 7 times that of Grey Hydrogen from Natural gas. This is a major challenge to Green Hydrogen deployment in Canada.

This again explains why 62% of the global Hydrogen fuel produced is from Natural gas without CCUS as shown below:

Hydrogen production costs (Ajanovic, Sayer and Haas 2022)

b. Transportation challenges

Hydrogen is very volatile. It must be safely transported in leak-proof specialised materials as it can result in an explosion when it mixes with air (Yang et al. 2021). Also, because it has very low density, it is best transported by steel pipeline after an energy intensive liquefaction process (Li et al. 2022). Building and transporting it through large networks of Hydrogen pipeline across Canada is a challenge and adds to the final cost of Hydrogen fuel in the market.

Canada’s Green Hydrogen policy’s barrier mitigation strategy

Since Green Hydrogen is itself tied to Renewable energy electricity, Canada’s clean energy policy introduced ‘Canada’s Hydrogen strategy’ (Government of Canada 2022) which is focused on improving the Levelised cost of Renewable energy electricity for Green Hydrogen production and how Canada’s industries will transition into a Hydrogen economy by 2050.

- Mitigating cost barrier

Canada’s ambition towards Green Hydrogen for hard to abate sectors makes now the best time to invest in this technology. According to the policy, Canada will invest $3bn over 5 years in innovative clean energy technologies. Canada’s strategy is simply to drive down the feedstock’s (electricity) price and leverage on technological innovation that can help build economies of scale. The report also shows that Canada will require its public funded projects to factor in clean Hydrogen in its energy mix. This will boost low carbon Hydrogen supply chain and production output which will in turn drive down the cost curve to at least same level as blue Hydrogen by 2030 according to the strategy.

- Mitigating Hydrogen transportation challenge

Effective distribution network is critical to Canada’s widespread adoption of Hydrogen fuel. Canada’s Hydrogen strategy claims that the nation can use their wide and extensive network of gas pipeline to also distribute Hydrogen which puts them at a competitive advantage as a top global oil and gas producer. Separate research by Zhang et al. (2023) says that although there is a concern for a Hydrogen embrittlement of steel pipes, the concern will be very insignificant for high strength steel used in gas pipelines. However, the paper also stated that the impurities in gas pipelines like CH4, CO2, H20, etc. makes it unsuitable for transporting pure Hydrogen fuel.

The Canadian policy also proposed blending Hydrogen with natural gas which it claims does not have a significant effect on the end use applications. While Kappes and Perez (2023) did not discuss or refute this claim, the conclusion of their latest research says that such blending will compromise the integrity of the steel pipe.

Investors must be aware that building a dedicated Hydrogen pipeline network across Canada appears to be the safest way for distributing Hydrogen and this is capital intensive. A separate analysis by the US Government estimates the cost to be at $520,000/mile for building Hydrogen pipeline with 50 years lifetime (Office of Energy Efficiency & Renewable Energy 2016). Canada’s policy did not state any future budget/commitment of building such wide and extensive pipeline network.

Green Hydrogen’s contribution to Canada’s present and potential Energy mix

Available data shows that Green and Blue Hydrogen do not yet have any significant input to Canada’s present energy mix (Government of Canada, National Energy Board 2022). However, Canada through a Private sector partnership has recently announced a $4 billion Green Hydrogen plant that will be completed by 2028 (Financial Times 2023). When completed, this plant will be able to produce 70,000 tonnes green hydrogen per year.

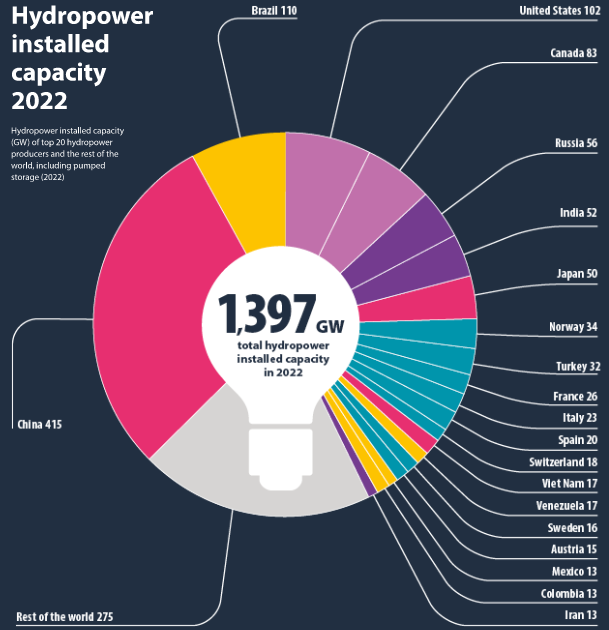

Since Green Hydrogen is produced by the electrolysis of water using renewable energy electricity, transiting to a Hydrogen economy is largely dependent on the primary source of the energy which in this case is renewable energy. My research and analysis will guide investors on Canada’s readiness now and in the future to fully integrate Green Hydrogen into its energy mix. Canada has proven its capability in clean electricity as the nation is presently the 4th largest Hydroelectricity producer in the world.

2022 Global Hydropower installed capacity (International Hydropower Association 2023)

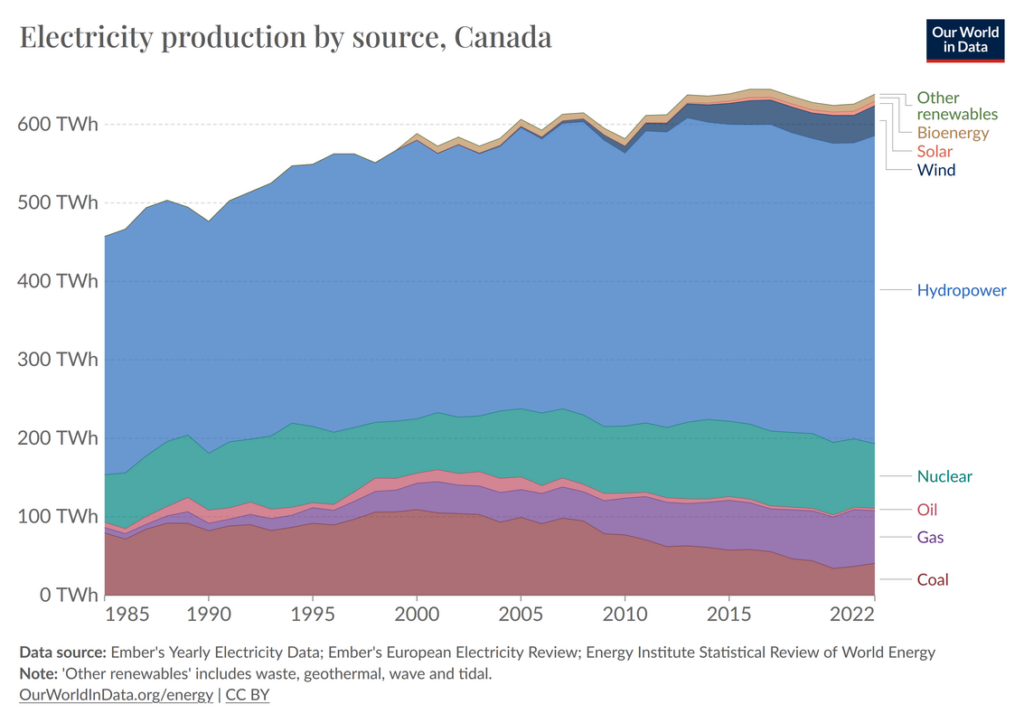

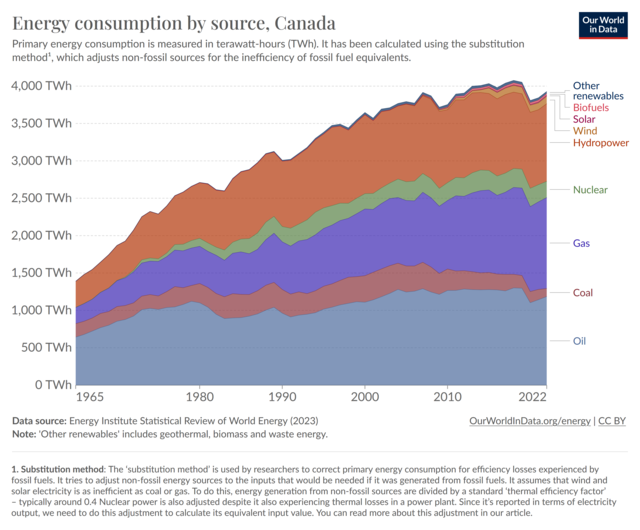

Canada claims to generate 82% of its electricity from clean technology and 67% of this from Hydroelectricity (Government of Canada 2022). This data is collaborated by Energy Institute’s statistical review (Energy Institute 2023) as interpreted below:

Canada’s Electricity mix (Energy Institute 2023)

My calculation from the data put Canada’s electricity from Renewables and Nuclear at 82.8% as at 2022.

This data is important to show that potential investors can leverage on Canada’s renewable energy capability and its Levelised Cost of renewable energy electricity as a primary source of energy to produce globally cost competitive Green Hydrogen.

The end use application of (Green) Hydrogen is not only in electricity generation but across all energy sectors.

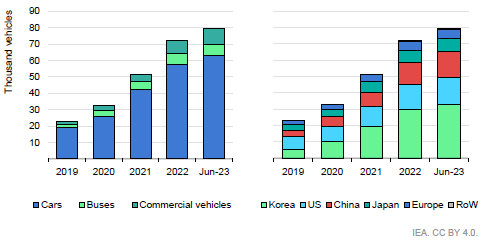

Investors, for example, should note that Hydrogen fuel cell electric vehicle stock globally is on steady increase:

Fuel cell Electric Vehicle stock 2019 -2023 (IEA, 2023b)

However, when it comes to the overall Energy mix of Canada, it’s worth mentioning that Fossil fuel still dominate the scene with oil, gas and coal taking 64%.

Canada Energy consumption by source. (Ritchie Roser and Rosado 2022) data from (Energy Institute 2023)

From investment point of view, this data shows that the low cost of substituting to natural gas and fossil fuel, and the huge infrastructural challenges in building Hydrogen pipelines, together with the cost of adapting end use applications to use Hydrogen fuel, will pose high threat of entry for investors according to Porter’s five forces (Porter 2008).

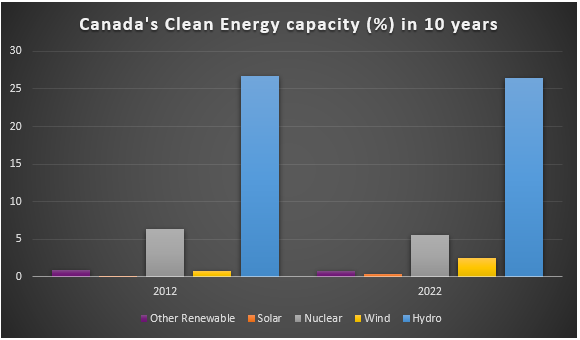

I have also narrowed my focus to Canada’s renewable and nuclear energy capability over a 10-year period (2012 – 2022) as shown below.

Canada’s clean energy capacity 2012 and 2022 by Author (Peter Ojike), adapted from (Energy Institute 2023)

My observation is that other than Hydroelectricity, Canada has not shown a very impressive investment in Solar and Wind energy system deployment from 2012 to 2022 despite the huge solar and wind resources it has when compared to other countries in the Global North. Its solar capacity for example moved from 0.06% in 2012 to 0.4% while that of the United States moved from 0.1% to 2.2% in 2022. The more capability and a deployment a country has for a particular renewable energy source, the better its supply chain and low Levelised cost of electricity of that source and competitiveness. Potential investors must decide the most cost competitive renewable energy source in Canada. Bennett et al. (2023) recommends that Canada needs to generate up to 16.5 times more clean electricity, and that covering 7.3% of the land mass used in oil and gas production in Alberta with PVs will completely decarbonise the grid.

Green Hydrogen in Canada’s future energy mix

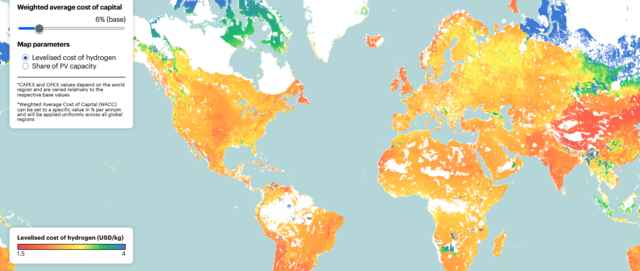

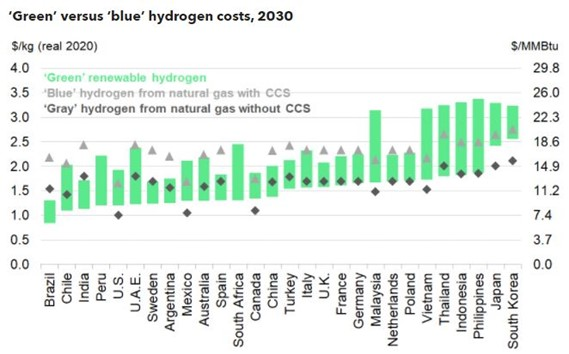

Canada has an ambitious plan of generating 30% of its 2050 net zero energy mix from clean Hydrogen (Government of Canada 2022). Again, this could be either blue or green Hydrogen. Below is IEA (IEA 2023c) 2030 prediction of the global Levelised cost of Green Hydrogen from PV and wind, which shows Canada’s capability in producing cost competitive Green Hydrogen by 2030.

Levelised cost of Hydrogen – 2030 (IEA 2023c).

Considering the global concerns for climate change and several national and international pro renewable energy policies with 28 of such policies currently in force in Canada (IEA 2023d), investing in Green Hydrogen instead of Blue Hydrogen will likely be worthwhile especially in a 2050 net zero scenario, and most importantly considering BloombergNEF’s prediction that the 2030 cost of Blue Hydrogen will be same as Green Hydrogen in Canada.

Green vs Blue Hydrogen Cost, 2030 (BloombergNEF 2021)

The data also reveals that Canada’s Green Hydrogen fuel will be cheaper than that of several other top producers especially China who has an economies of scale advantage with regards to Electrolyser manufacturing.

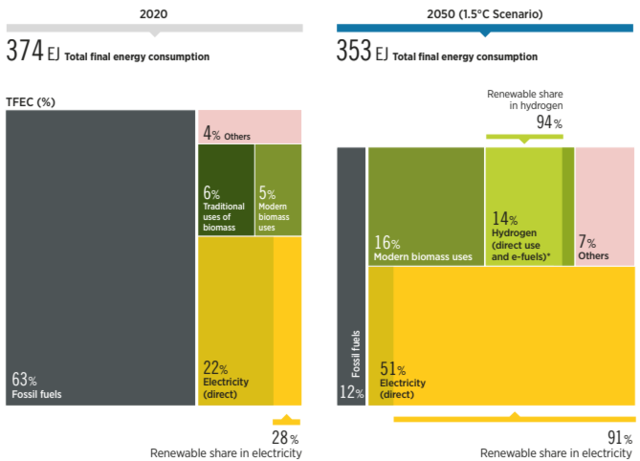

This data is somewhat collaborated by IRENA (2023)’s prediction that the global Green Hydrogen’s use will surpass fossil fuel in 2050 global energy mix.

2050 Net zero Scenario (IRENA 2023)

Going by the 2050 projected estimates, the use of fossil fuel will reduce significantly, and its cost will go up because of Climate friendly regulations, Carbon pricing and decrease in demand for end use applications (IEA 2023). One of those regulations includes Canada’s proposed ban of combustion engine vehicles and light-duty trucks by 2035 (Transport Canada, 2021b). The proposal further states that Canada had committed $1bn to encourage zero emission vehicle adoption. This includes building new electric and Hydrogen charging stations. All of these proposals will improve the prospect of Green Hydrogen market in Canada.

IRENA (2023) recommends that countries that wish to transit into a Hydrogen economy should invest in their Green Hydrogen supply chain which includes electrolysers, Hydrogen pipelines, storage caverns, etc.

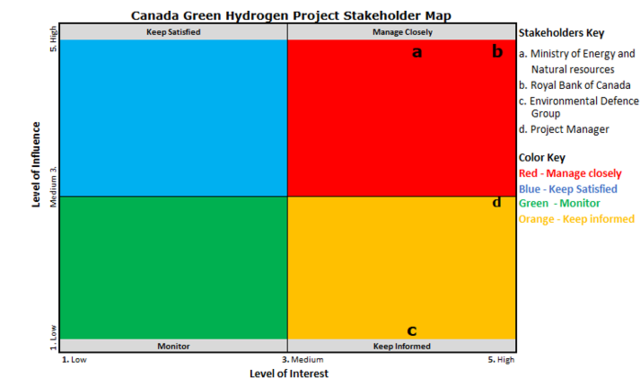

Stakeholder analysis for the building of $4billion Green Hydrogen plant in Quebec Canada

Identified Analysis:

For clarity, because of space, I will break my Stakeholder register into 2 tables:

| Stakeholder | Position | Type | Category | Role | Contact |

| 1. Ministry of Energy and Natural resources | Government Agency | Political | Primary | Regulatory/Compliance | |

| 2. Royal Bank of Canada | Bank | Economic | Primary | Financier and investor | |

| 3. Environmental Defence Group | Pressure group | Social | External | Advocacy Group | Mobile |

| 4. Project Manager | Project Management Office | Internal | Internal | Project Manager | Mobile |

Table 1: Stakeholder Register

2.2.2 Stakeholders register with Management strategy (Treat as Template only)

| Name | Level of Influence (1-5) | Level of Interest (1-5) | Management Strategy |

| Ministry of Energy and Natural resources | High – 5 | High – 4 | This Agency is very much concerned about the project meeting the regulatory and compliance requirements embedded in Canada’s A Healthy Environment and a Healthy Economy – Clean industry policy. Not only that, but the Ministry is also concerned that Canada may not meet up to its 2030 Carbon reduction target as promised in that policy. The Agency therefore expects this project to be completed before 2028 which is critical to meeting the 2030 target as the nation transit into hydrogen economy especially for its industries and hard to abate sectors. Prioritise and manage this stakeholder very closely with regular updates. Real effort must be made to always understand their expectations. |

| Bank of Canada | High – 5 | High – 5 | As the financier and investor in this project, the Bank is worried about what it has accessed to be a high probability of a risk event and the impact to the project where either the project isn’t completed on time and in budget or the selling price of the produced Green Hydrogen is less than the overall cost price. The financier is banking on Government’s policy under consideration to enforce the adoption of Green Hydrogen in end use applications, since the profitability of this project is tied to the demand of Green Hydrogen from the market. As a long-time investor, the bank expects the Government to meet its 2030 and 2050 net zero targets which will drive down the Levelised cost of Green Hydrogen giving it a competitive advantage over natural gas by 2030. The bank is also concerned about unforeseen external political and economic event that may disrupt the global hydrogen supply chain or affect bank interest rate which will impact on their profitability on the investment. The Bank has also asked its team member to monitor closely the demands and expectation of the Environmental Defence group as their action can potentially disrupt the actualising of this project. The Bank’s expectation is simply for everything to go as planned and for the site to be commissioned by 2028. Manage very closely by addressing their concerns while remaining realistic and transparent. |

| Environmental Defence Group | Low – 1 | High – 4 | While this group has shown admiration and support for this green project, they appear to be a potential disruptor of this project. They appear to have several activists or groups within this group with a range of concerns. The least of concern may be those who are worried about the global supply chain of the electrolyser calling for ethical mining of the hard metals used in manufacturing the electrodes. Some are also worried that although a Hydrogen pipeline construction is not within the scope of this project, in the future, a dedicated pipeline will have to run across the Leaf River to the site which will impact on the biodiversity of the river. The rest of the groups identified completely opposes deforestation and are worried about the unavoidable destruction of natural habitats of birds and bats when construction begins. Keep them informed on the compliance requirement in the ‘A Healthy Environment and a Healthy Economy – Clean industry’ policy. Get familiar with the Environmental Impact Assessment and the Environmental Scoping report to properly inform them of the several environmental risk mitigation strategies in place. Actively listen to them to understand their concerns. They can become allies when properly managed since the project itself is a green project. |

| Project Manager | Medium – 3 | High – 5 | Peter’s expectation is for this project to be delivered within the budget. He is aware of the 2030 carbon reduction target in the policy document and how important delivering this project on time is to his office and government stakeholders. He has expressed concern over several scope creeps and in getting approvals from the senior management as timely as possible. Keep him informed on all decisions pertaining to this project. |

Table 2: Stakeholders register with Management strategy.

Stakeholder Map (Treat as Template only)

Using the analysis from the Stakeholders register in Table 2, find my Stakeholder map below for more illustrative analytical use.

Stakeholder map by Wavetra

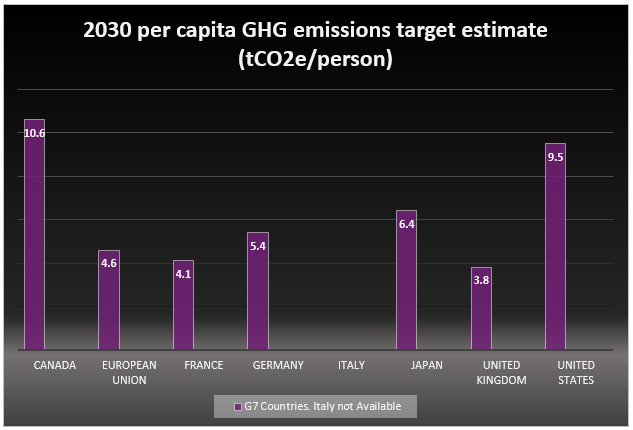

UK’s Hydrogen strategy

The United Kingdom has a Net zero strategy policy (HM Government 2021) and like Canada’s, UK has its Hydrogen strategy embedded in the policy and published in fuller details as a separate document (HM Government 2021b) UK is an ideal comparator country with the most ambitious 2030 GHG emission reduction target among G7 countries as shown below.

G7 2030 GHG Emissions target by Author. Data from Gov.uk (2023)

UK appears to have a more strategic approach to its Hydrogen strategy. For example, as of 2022, the country’s Green Hydrogen projects are well distributed across the regions.

Evidence shows that unlike natural gas which is extracted from a source and distributed via pipeline, Green Hydrogen can be produced anywhere by water electrolysis, and it is usually consumed close to where it is produced (U.S. Department of Energy 2019). Unlike Canada, UK’s strategic clustering of Green Hydrogen projects will help maximise the resource optimisation along the green hydrogen value chain in each region and boost the supply chain with each plants sharing infrastructure. This strategy will eventually mitigate the risk of supply security when demand peaks and most importantly will reduce the need and cost implication for a nationwide network of Hydrogen pipelines as other means of transportation can easily deliver produced Hydrogen from nearby plants to where it is consumed. Investors like the Royal Bank of Scotland will not only depend on Government policies for Green Hydrogen adoption as the even spread of the projects across UK will help in Green Hydrogen use penetration, and the LCOH will reduce because of abundant and steady supply and increase demand which eventually gives it a competitive advantage over Natural gas as BloombergNEF predicted (Figure 13).

Yet, UK’s Hydrogen strategy clearly recognises the need for a dedicated Hydrogen pipeline. Unlike Canada’s proposal of pumping Hydrogen via gas pipelines, UK plans to repurpose and convert 25% of its gas pipeline from decommissioned transmission assets, to dedicated Hydrogen pipeline. This approach will eliminate the risks of impurity and steel pipe integrity compromise in Canada’s proposal of using the same pipeline for gas and Hydrogen transportation as recent research showed (Kappes and Perez 2023; Zhang et al. 2023). The UK Hydrogen strategy document also revealed a new national grid project that will see the construction of a new dedicated 2,000km Hydrogen pipeline across UK. The document also briefly discussed a European plan of building a pan-European Hydrogen pipeline network to ensure Energy security in Europe.

In terms of a government regulatory framework and policies as a driver to Green Hydrogen adoption, in the August 2023 update of UK’s Hydrogen strategy progress (HM Government, 2021b), the update outlines new Government policies and frameworks including:

- Offshore Hydrogen regulation consultation

- Hydrogen sector development action plan

- UK Hydrogen Investment Roadmap

These, together with the existing policies and frameworks, is aimed at improving the utilisation and adoption of Green Hydrogen. For example, the government is testing about 300 hundred Hydrogen buses across UK, and they are piloting a Green Hydrogen home heating system in Fife (HM Government, 2021b). The framework will also encourage investment through subsidies and PPPs, create more green Hydrogen end use applications and build more transmission network infrastructure. All these will mitigate the risks associated with Green Hydrogen adoption and it, staying cost competitive which are the primary concerns of the stakeholders in Canada.

Strategic recommendation for a prospective Green Hydrogen investor in Canada

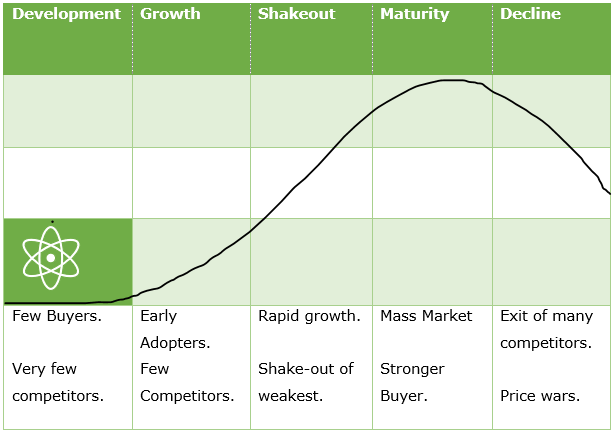

From my analysis of Canadian policy under consideration and progress in Green Hydrogen development, The Green Hydrogen industry lifecycle shown below can help us make the following strategic recommendations to prospective investors:

Green Hydrogen in Canada Industry Lifecycle by Wavetra adapted from (Johnson et al. 2014).

- Have a Long-term goal strategy:

The Green Hydrogen market in Canada is still in the development stage, and behind UK’s in the same stage. Investing in such emerging industry comes with high uncertainties and risks which is reflected in Royal Bank of Canada’s fears. However, with the government regulations and frameworks in place, investors can be optimistic that the industry will develop to maturity. I recommend that any prospective investor must have a long-term strategic approach as the industry and Green Hydrogen technology develops further.

- Build an Ecosystem:

We also observe from the Industry lifecycle (Figure 19) that there are very few competitors in this industry at this early stage. The negative implication is that the supply chain and Green Hydrogen ecosystem in Canada is also not developed. UK’s advantage over Canada in this regard is in the clustering of Green Hydrogen. If prospective investors can collaborate and cluster their projects in one region at a time, they will be able to share resources, risks and build economies of scale. Most importantly, they will reduce the risk of relying only on Hydrogen pipeline for delivery as Green Hydrogen is often consumed close to where it is produced (U.S. Department of Energy 2019).

Conclusion

Although Green Hydrogen is still in its early stage with no significant contribution to Canada’s energy mix today, investing in the technology can be worthwhile considering Canada’s green policies, IRENA, and IEA’s prediction on the role of Green Hydrogen in 2050 net zero scenario (IEA 2023; IRENA 2023). However, investors must carefully access the risks related to Canada’s apparent reluctance, unlike UK, in clearly articulating their future commitment towards building a dedicated Hydrogen pipeline network, using UK as a benchmark comparator G7 country.

References

AJANOVIC, A., SAYER, M. and HAAS, R., 2022. The economics and the environmental benignity of different colors of hydrogen. International Journal of Hydrogen Energy, 47(57), pp. 24136-24154.

BENNETT, C. et al., 2023. Decarbonizing Canada’s energy supply and exports with solar PV and e-fuels. Renewable Energy, 217, pp. 119178.

Canada, N.R. (2022). The Hydrogen Strategy. [online] natural-resources.canada.ca. Available at: https://natural-resources.canada.ca/climate-change-adapting-impacts-and-reducing-emissions/canadas-green-future/the-hydrogen-strategy/23080. [Accessed: 16 December 2023].

Energy Institute (2023). 2023 Statistical Review of World Energy. [online] Energyinst.org. London: Energy Institute. Available at: https://www.energyinst.org/__data/assets/pdf_file/0004/1055542/EI_Stat_Review_PDF_single_3.pdf [Accessed 15 Dec. 2023].

Environment and Climate Change Canada (2021). A Healthy Environment and a Healthy Economy. [online] Government of Canada. Available at: https://www.canada.ca/en/environment-climate-change/news/2020/12/a-healthy-environment-and-a-healthy-economy.html [Accessed 15 Dec. 2023].

Financial Times (2023). Canada lines up $4bn green hydrogen project in cleantech push. [online] www.ft.com. Available at: https://www.ft.com/content/2bf0fa89-b105-4a1c-9a98-bc4a71f95b6c [Accessed 16 Dec. 2023].

FRANCO, A. and GIOVANNINI, C., 2023. Routes for Hydrogen Introduction in the Industrial Hard-to-Abate Sectors for Promoting Energy Transition. Energies, 16(16).

Gov.uk (2023). International emissions comparisons for G7 countries. [online] GOV.UK. Available at: https://assets.publishing.service.gov.uk/media/652eb135d86b1b00143a515a/g7-emissions-summary.xlsx [Accessed 15 Dec. 2023].

Government of Canada (2023). Net-Zero Emissions by 2050. [online] Government of Canada. Available at: https://www.canada.ca/en/services/environment/weather/climatechange/climate-plan/net-zero-emissions-2050.html. [Accessed: 16 December 2023].

Government of Canada, National Energy Board (2022). CER – Provincial and Territorial Energy Profiles – Canada. [online] Cer-rec.gc.ca. Available at: https://www.cer-rec.gc.ca/en/data-analysis/energy-markets/provincial-territorial-energy-profiles/provincial-territorial-energy-profiles-canada.html [Accessed 15 Dec. 2023].

HM Government (2021). Net Zero Strategy: Build Back Greener. [online] GOV.UK. Available at: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1033990/net-zero-strategy-beis.pdf [Accessed 15 Dec. 2023].

HM Government (2021b). UK Hydrogen Strategy. [online] Gov.uk. London: HM Government. Available at: https://assets.publishing.service.gov.uk/media/64c7e8bad8b1a70011b05e38/UK-Hydrogen-Strategy_web.pdf [Accessed 15 Dec. 2023].

IEA (2023a). A Healthy Environment and a Healthy Economy – Clean industry – Policies. [online] IEA. Available at: https://www.iea.org/policies/12692-a-healthy-environment-and-a-healthy-economy-clean-industry [Accessed 15 Dec. 2023].

IEA (2023c). Hydrogen production projects interactive map – Data Tools. [online] IEA. Available at: https://www.iea.org/data-and-statistics/data-tools/hydrogen-production-projects-interactive-map [Accessed 15 Dec. 2023].

International Hydropower Association (2023). 2023 World Hydropower Outlook. [online] hydropower.org. London: International Hydropower Association. Available at: https://www.hydropower.org/publications/2023-world-hydropower-outlook [Accessed 16 Dec. 2023].

IRENA (2023). WORLD ENERGY TRANSITIONS OUTLOOK 2023. [online] IRENA. Available at: https://mc-cd8320d4-36a1-40ac-83cc-3389-cdn-endpoint.azureedge.net/-/media/Files/IRENA/Agency/Publication/2023/Jun/IRENA_World_energy_transitions_outlook_v1_2023.pdf [Accessed 15 Dec. 2023].

JOHNSON, G. et al., 2014. Exploring strategy. Harlow: Pearson Education.

KAPPES, M.A. and PEREZ, T.E., 2023. Blending hydrogen in existing natural gas pipelines: integrity consequences from a fitness for service perspective. Journal of Pipeline Science and Engineering, pp. 100141.

LI, H. et al., 2022. Safety of hydrogen storage and transportation: An overview on mechanisms, techniques, and challenges. Energy Reports, 8, pp. 6258-6269.

Office of Energy Efficiency & Renewable Energy (2016). DOE Technical Targets for Hydrogen Delivery. [online] Energy.gov. Available at: https://www.energy.gov/eere/fuelcells/doe-technical-targets-hydrogen-delivery [Accessed 15 Dec. 2023].

OKUNLOLA, A. et al., 2022. Techno-economic assessment of low-carbon hydrogen export from Western Canada to Eastern Canada, the USA, the Asia-Pacific, and Europe. International Journal of Hydrogen Energy, 47(10), pp. 6453-6477.

PALTSEV, S. et al., 2021. Hard-to-Abate Sectors: The role of industrial carbon capture and storage (CCS) in emission mitigation. Applied Energy, 300, pp. 117322.

PORTER, M.E., 2008. The five competitive forces that shape strategy. Harvard business review, 86(1), pp. 78.

PRUSSI, M. and CHIARAMONTI, D., 2022. Alternative fuels for hard-to-abate sectors: a carbon intensity assessment. Journal of physics. Conference series, 2385(1), pp. 12044.

Transport Canada (2021b). Building a green economy: Government of Canada to require 100% of car and passenger truck sales be zero-emission by 2035 in Canada. [online] www.canada.ca. Available at: https://www.canada.ca/en/transport-canada/news/2021/06/building-a-green-economy-government-of-canada-to-require-100-of-car-and-passenger-truck-sales-be-zero-emission-by-2035-in-canada.html [Accessed 15 Dec. 2023].

WAPPLER, M. et al., 2022. Building the green hydrogen market – Current state and outlook on green hydrogen demand and electrolyzer manufacturing. International Journal of Hydrogen Energy, 47(79), pp. 33551-33570.

YANG, F. et al., 2021. Review on hydrogen safety issues: Incident statistics, hydrogen diffusion, and detonation process. International Journal of Hydrogen Energy, 46(61), pp. 31467-31488.

ZHANG, H. et al., 2023. Research progress on corrosion and hydrogen embrittlement in hydrogen–natural gas pipeline transportation. Natural Gas Industry B.